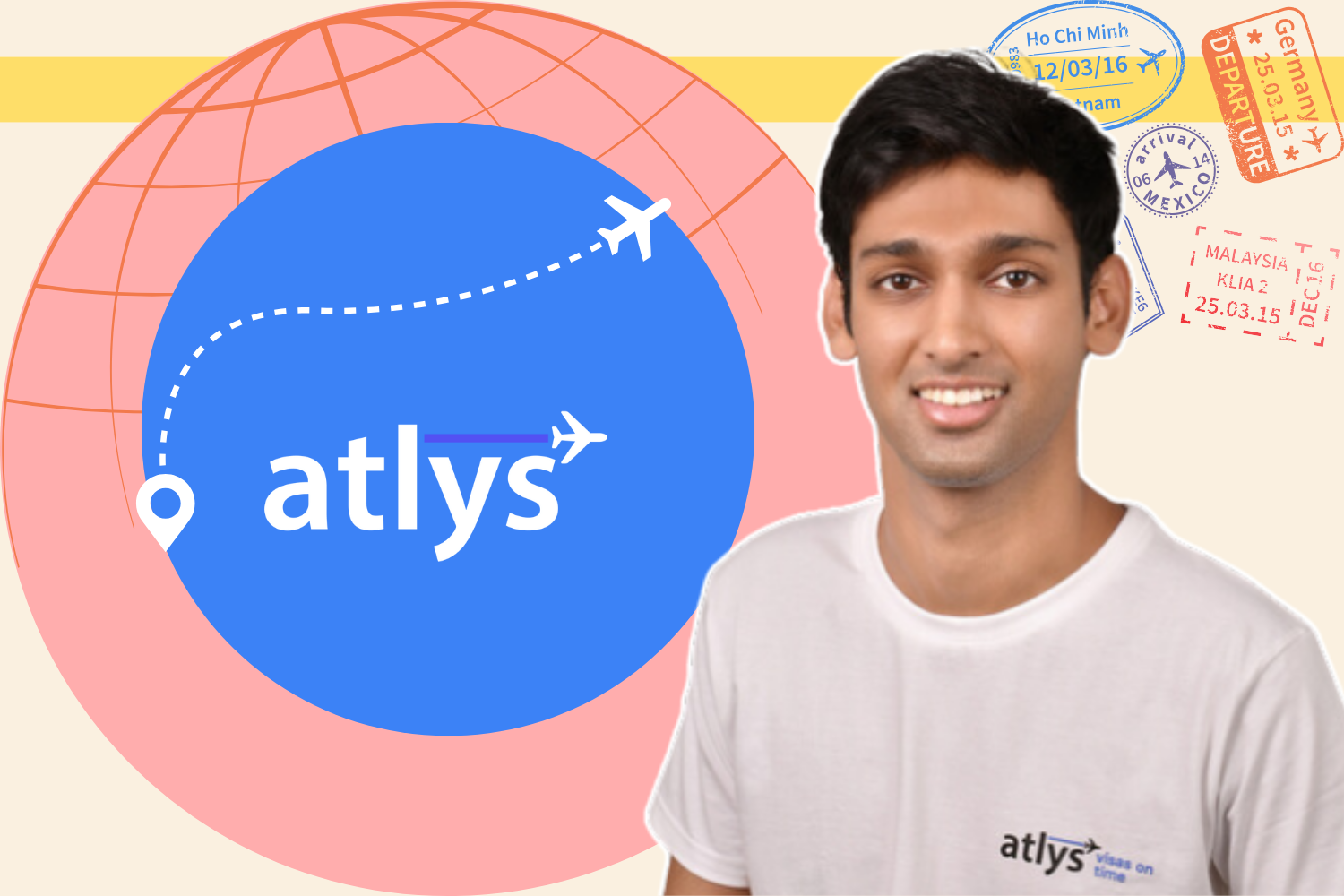

Atlys raises $20M in Series B led by Peak XV and Elevation Capital

Visa processing platform Atlys has raised $20 million in its Series B round, co-led by Peak XV Partners and Elevation Capital, with participation from DST Global and Headline. The funding will drive Atlys' global expansion, product development, and entry into new markets. The three-year-old startup streamlines visa processes, reducing rejection rates and processing times to just 55 seconds. Atlys handles over 30,000 visa applications monthly, with India contributing 60%. Founder Mohak Nahta highlighted the company's 20x growth and the critical need for seamless visa processing amid India’s rising outbound tourism.