Milky Mist Strengthens Board with Independent Directors Ahead of ₹2,000 Crore IPO

Milky Mist appoints independent directors ahead of its ₹2,000 crore IPO, strengthening governance as it prepares to expand nationally and enter public markets in 2025.

Discover 12 articles related to IPO

Milky Mist appoints independent directors ahead of its ₹2,000 crore IPO, strengthening governance as it prepares to expand nationally and enter public markets in 2025.

Digital lending platform KreditBee has shifted its headquarters from Singapore to India and merged its Indian arms—Finnovation Tech and KrazyBee Services—as it prepares for a $500 million IPO. Backed by Advent International and other major investors, the company plans a pre-IPO round and eyes long-term alignment with Indian capital markets.

Zetwerk has launched a state-of-the-art manufacturing facility in Chennai, reinforcing its position in India’s electronics sector. The plant, expected to generate 1,200 jobs, will produce essential components for household appliances and IT hardware. Zetwerk also eyes a $500 million IPO, signaling its ambition for rapid growth and market expansion.

Zetwerk is set to file IPO draft papers, aiming to raise $400-$500 million, targeting a $5 billion valuation. The company has appointed six banks to manage the process.

Urban Company’s shift to a public entity signals its IPO ambitions. Strong financials, strategic growth, and investor backing position it well for public listing and long-term industry leadership.

Solarium Green Energy's ₹105 crore SME IPO opens on February 6, aiming to raise funds for expansion. With strong financials and a proven track record in solar solutions, investor interest is expected.

OfBusiness has converted to a public company ahead of its anticipated 2025 IPO. The company plans to raise $1 billion, leveraging strong financial performance and investor backing to expand its procurement platform.

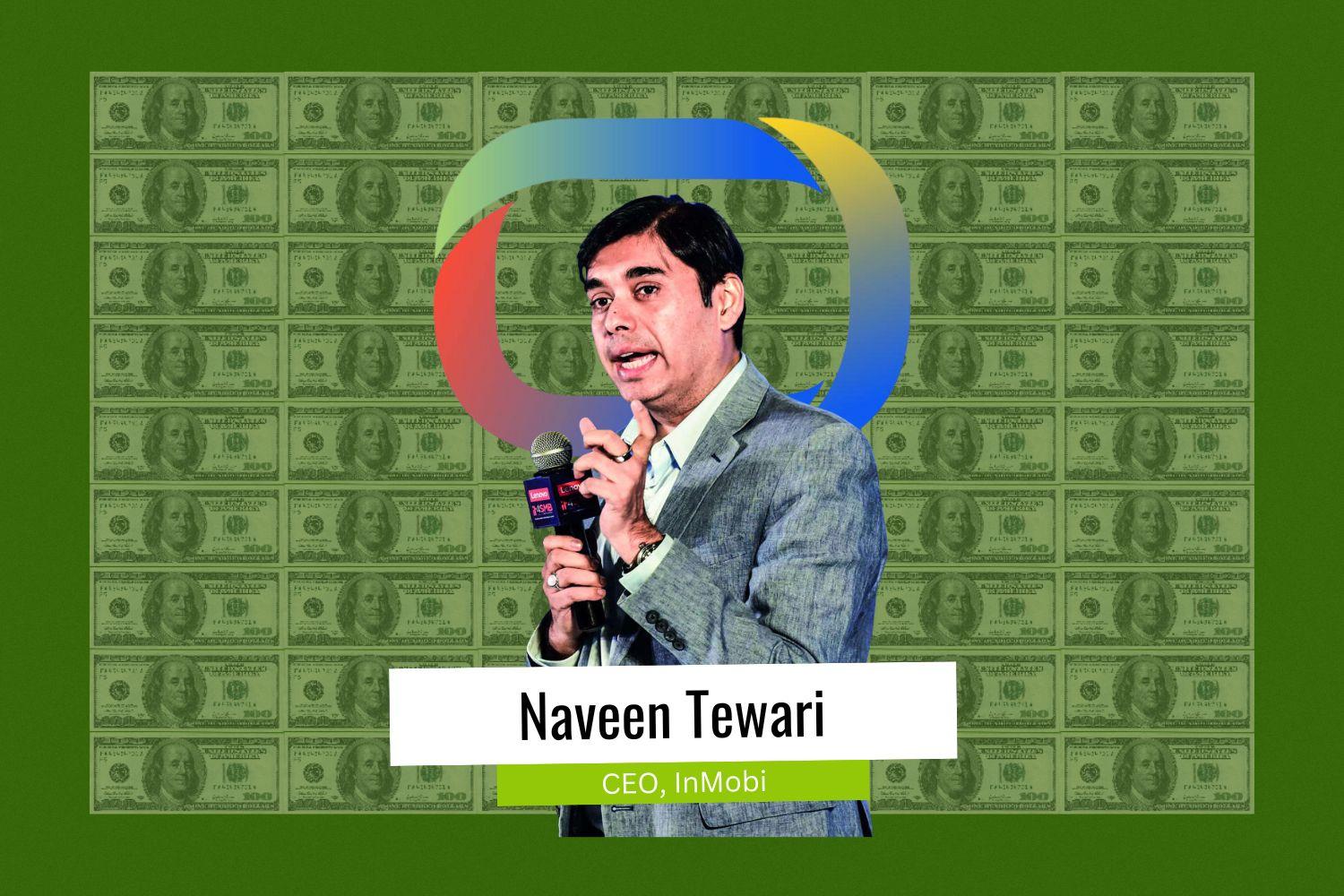

InMobi plans to file for a $1 billion IPO by April 2025, targeting an $8-10 billion valuation. The adtech unicorn's growth strategy includes AI investments, relocation to India, and leveraging its Glance platform to attract global investors.

Fintech unicorn Groww has appointed JPMorgan and Kotak Mahindra as lead bankers for its upcoming IPO, targeting $750 million. Founded in 2016, Groww has grown into India’s largest retail stockbroker. The IPO aligns with India’s booming capital market, with plans to expand its financial services offerings further.

India's food and grocery delivery giant, is set to go public on November 6, aiming for an $11.3 billion valuation—a decrease from prior estimates. This IPO arrives amid mixed investor sentiment, with a grey market premium trading at a modest 5% above the price band. Swiggy aims to raise ₹11,327 crore, blending fresh equity with an offer-for-sale from key backers like Accel and Tencent. Institutional support is strong, with major investors, including Norway’s sovereign wealth fund, showing substantial interest. Despite financial losses in FY24, Swiggy’s expansion into groceries and other services is driving long-term investor confidence.

Oyo, the Indian hotel chain startup, is nearing a deal to raise between $100 million and $125 million, slashing its valuation to $2.5 billion from a previous $10 billion in 2019, according to TechCrunch. The company has faced challenges raising from institutional investors and has recently targeted high-net-worth individuals, emphasizing its profitability and significant valuation discount. Amidst these fundraising efforts, Oyo has retracted its plans for an IPO, previously aiming for a $1.2 billion raise at a $12 billion valuation in 2021. The company, with backers including SoftBank and Airbnb, has withdrawn its IPO application twice in four years, indicating a strategic pivot away from rapid global expansion to stabilizing its core operations.

Ola Electric has received SEBI's go-ahead for an IPO to raise ₹7,250 crore, enhancing its stance in the electric vehicle (EV) landscape. This IPO will consist of a new issuance worth ₹5,500 crore and an offer for sale amounting to ₹1,750 crore. The company is at the forefront of the EV market in India, particularly in the two-wheeler sector. The capital from this IPO is planned for extensive capital expenditures and for reducing debt, thereby boosting Ola's innovation efforts in EV technology. Furthermore, Ola intends to deepen its research and development to drive further advancements in electric mobility. This move is seen as a strategic effort to solidify Ola's presence in a fast-evolving industry.